Financial Student Aid Office is responsible for processing applications and aid for students who meet eligibility requirements.

For undergraduates’ students, the financial assistance available is Pell Grant and subsidized and unsubsidized loans from the William D. Ford Federal Direct Loan Program, a division of the U.S. Department of Education.

For graduate students, the financial assistance available is unsubsidized loans from the William D. Ford Federal Direct Loan Program as well. Student loans provided is to enable a student to only pay for the educational cost.

Overview of Direct Unsubsidized Loans:

· Direct Unsubsidized Loans are available to undergraduate and graduate students; there is no requirement to demonstrate financial need.

· Your school determines the amount you can borrow based on your Cost of Attendance (COA) and other financial aid you receive.

· You are responsible for paying the interest on a Direct Unsubsidized Loan during all periods.

· If you choose not to pay the interest while you are in school and during grace periods and deferment or forbearance periods, your interest will accrue (accumulate) and be capitalized (that is, your interest will be added to the principal amount of your loan).

To complete the FAFSA and financial aid requirements, go to https://studentaid.gov/ and remember, you will need a valid FSA ID. This may require an approximate minimum time of 30 minutes.

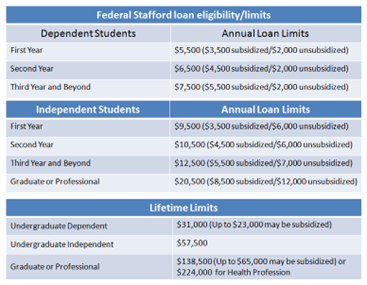

· Annual Federal Student Loan Limits:

- Entrance Counseling

- This process is to help you understand what it means to apply for a federal student loan and your responsibilities with the ED. At the end of your studies, you must repay the total amounts with interest. So be aware of the amounts you request every academic term.

- Master Promissory Note (MPN)

- The MPN includes the terms and conditions of the student’s loan and you need the information of two personal references (preferably family not leaving with you and they must have a different postal address).

- Annual Student Loan Acknowledgment

- If this is your first time accepting a federal student loan, you are acknowledging that you understand your responsibility to repay your loan.

- If you have existing federal student loans, you are acknowledging that you understand how much you owe and how much more you can borrow.

- Exit Counseling

- Exit counseling provides important information to prepare you to repay your federal student loan(s).

- If you have received a subsidized, unsubsidized, or PLUS loan under the Direct Loan Program or the FFEL Program, you must complete exit counseling each time you:

- Drop below half-time enrollment.

- Graduate

- Leave school.

To know more, go to: https://studentaid.gov/understand-aid/types

Licencias/Acreditaciones:

Effective January 31, 2022, this nursing program is a candidate for initial accreditation by the Accreditation Commission for Education in Nursing. This candidacy status expires on January 31, 2024. Accreditation Commission for Education in Nursing (ACEN) 3390 Peachtree Road NE, Suite 1400 Atlanta, GA 30326 (404) 975-5000 http://www.acenursing.com/candidates/candidacy.asp Note: Upon granting of initial accreditation by the ACEN Board of Commissioners, the effective date of initial accreditation is the date on which the nursing program was approved by the ACEN as a candidate program that concluded in the Board of Commissioners granting initial accreditation.